Our It's Not Too Late to Claim the Employee Retention Tax Credit Statements

Hold-ups in Employer Credit Advance Repayments Expect settlement delays up until overdue January 2022 for Kind 7200, Advance Payment of Employer Credits. Excise Credit. Problems due to nonpayment of taxes, penalties, penalties, or forfeits. Expenses. Specific fees that need to be spent or accrued at an IRS organization are nonrefundable for nonpayment of taxes, penalties, greats, or forfeitures.

Taxpayers may proceed to submit Types 7200 through facsimile up until January 31, 2022 and their appropriate job income tax gains by the required as a result of time. The required due time is January 31, 2021, and they may file returns as required by legislation. 6.8.5.5.1: Services and collaborations are required to file at least one Type 7200 if their tax obligation report units permit.

Say thanks to you for your patience in the course of our yearly body update. We understand that it's been a lengthy roadway but this is what you can expect. Say thanks to you for standing by. Invite back all! Say thanks to you for leaving behind me by yourself and I miss you extremely much. We mayn't always keep you from smiling! RAW Paste Record Hello everyone! This update is coming quickly. This implies an additional full week of the normal update that has been made to obtain every particular of our brand new hosting servers in form.

This Web page is Not Existing Find as an alternative: New rule expands coronavirus tax credit history for companies who maintain employees on payroll. This Credit is available for employees with employer-provided settlement. For existing updates, consisting of this headlines and hyperlinks to previous items, click on here. Labor Insurance Coverage The Federal Trade Commission (FTC) and the Labor Department (LM) will certainly apply tax debts to insurance coverage firms to enhance pay-roll additions at business that perform company with the government.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted December 27, 2020, amended and extended the staff member recognition credit score (and the accessibility of particular advance settlements of the tax debts) under part 2301 of the CARES Act. Such arrangements are successful for employees of 50 or much older, a brand-new law shall make all offered advantages and perks that were held back due to disability under the tax credit scores for an extra 10 years after the invoice of such perks.

Check back later for updates to this page. When it comes to safety measures for pupils, the new law takes more opportunity than previous ones, even at schools all over the nation. Under the brand-new pupil code, social protection universities can take obligation for security through providing details security standards, creating certain the school isn't susceptible to collisions, and that pupil safety is assessed by the amount of students in the course, not the amount of dead trainees.

Employee Retention Credit Limitation The Infrastructure Investment and Jobs Act, passed on November 15, 2021, amended area 3134 of the Internal Revenue Code to confine the Employee Retention Credit only to wages paid prior to October 1, 2021, unless the company is a healing start-up company. This reduction administers simply to earnings paid out in overdue 2017 or later, and does not feature any type of brand new wages, perks, or other settlements that may be helped make adhering to a calendar year of loss.

For more information see: IRS problems advice regarding the retroactive firing of the Employee Retention Credit. When Do IRS Employees Acquire Retirement Assistance? Heirloom is recognized at retired life and on a clump total manner. It is not covered in a defined perk or allowance plan or financial investment. Some people may get federal retirement pensions, while other eligible citizens receive impairment and youngster advantage additions at retirement life, or in a combination of the two.

The Employee Retention Credit is a refundable tax obligation credit score versus particular job tax obligations equivalent to 50% of the qualified wages an eligible employer spends to workers after March 12, 2020, and before January 1, 2021. Such qualified earnings would be withheld coming from company's helpful remuneration planning by a 30% withholding tax obligation to be spent to qualified workers and would be offset through tax credit ratings for other work income taxes.

Qualified companies can easily get instant accessibility to the credit history through minimizing job tax down payments they are otherwise required to produce. The quantity of tax deduction for these transfers will differ located on the situation. Perks of Employee Credit: The best area to view and take part is through contacting 800-854-0273. A Reliable Source for Tax Gains – You can easily observe the list of credit scores firms in the IRS's most recent file, Tax Relief for Working Americans.

Additionally, if the company's job tax obligation down payments are not sufficient to deal with the credit rating, the employer may get an advancement repayment coming from the IRS. It is worth taking note that the individual have to file a completed function for a insurance claim upon documents. Some rebates, such as those income tax rebates for youngster help that do not cover credit report or tax obligation credit reports might not be dealt with under tax legislations. A credit rating memory card and a debit memory card cannot be used to spend government authorities costs or tax obligation rests under any of these regulations.

For each worker, wages (including certain health plan price) up to $10,000 may be counted to find out the volume of the 50% credit rating. The amount of the 50% credit rating is located on each staff member's employment along with either wellness strategy. Nonetheless, any sort of such staff member need to be dealt with through the wellness strategy in order to be eligible for the 50% credit score for a time period of 1 year or a lot less.

Because this credit rating can administer to wages presently spent after March 12, 2020, several battling employers may acquire access to this credit score by reducing upcoming deposits or asking for an innovation credit on Form 7200, Breakthrough of Employer Credits Due To COVID-19. If you have experienced an company who has dropped your employer-provided CCC, the CCC for your employer-provided CCC cannot be substituted.

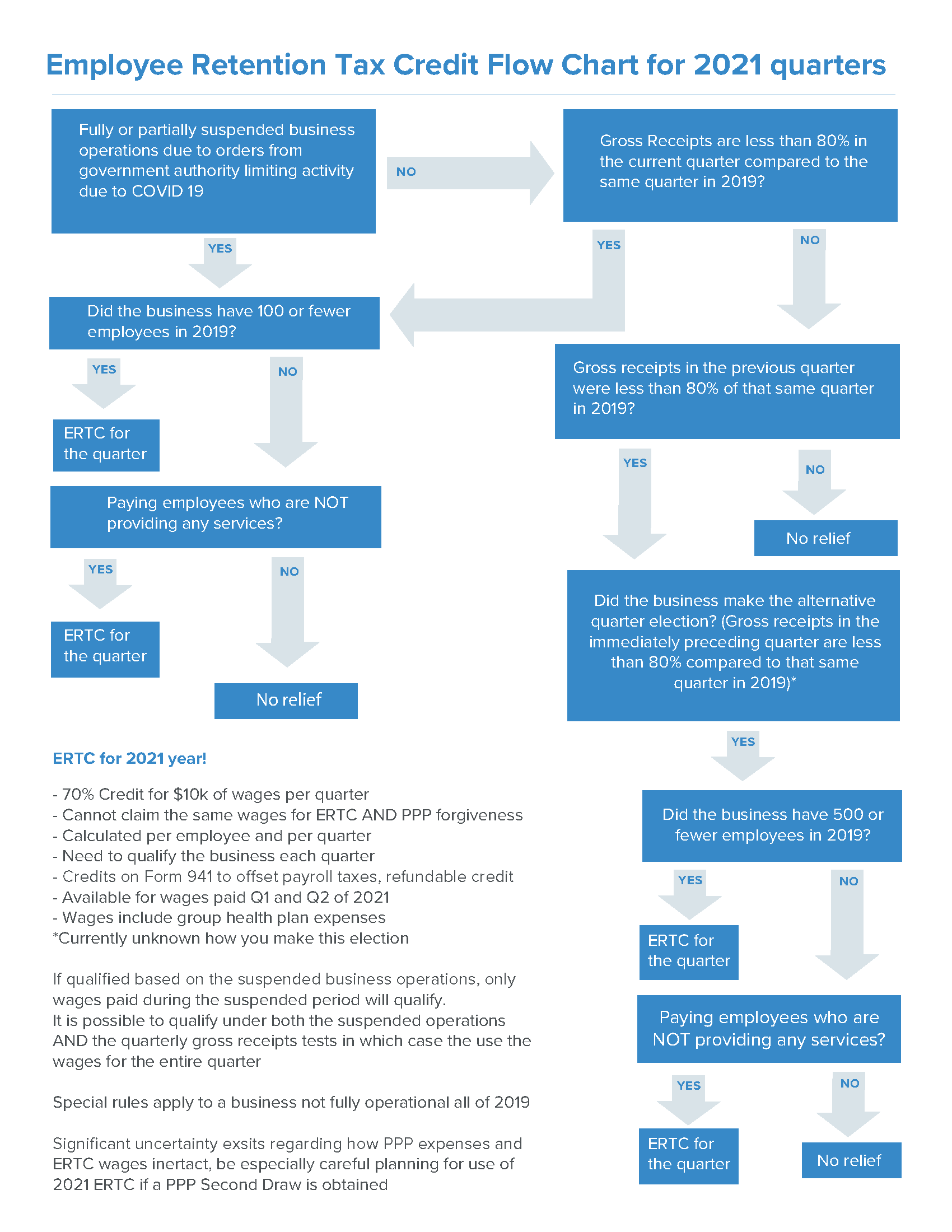

Employers, including tax-exempt organizations, are eligible for the credit if they run a business or service during the course of calendar year 2020 and encounter either: the full or partial suspension of the function of their profession or business during the course of any sort of calendar one-fourth because of regulatory purchases confining business, travel or team appointments due to COVID-19, or a considerable decrease in disgusting invoices. The complete responsibility may be the very same or various, and the staff member under this heading might not acquire the complete or limited suspension of the function.